The Membership Model in Fintech:

How Financial Brands Are Becoming Lifestyle Brands

The Membership Model in Fintech:

How Financial Brands Are Becoming Lifestyle Brands

The Membership Model in Fintech:

How Financial Brands Are Becoming Lifestyle Brands

For years, fintech sold products: cards, loans, budgeting tools, APRs, overdraft avoidance. It was transactional, functional, and aggressively rational. But the industry has quietly hit a ceiling. Consumers no longer want “a financial tool.” They want a financial identity, something that feels like them, supports their lifestyle, and softens the psychological friction around money.

That shift is why fintech’s next era isn’t defined by lending innovations or new rails. It’s defined by membership.

In 2025, over 72% of Gen Z consumers say they want financial products that “fit their life, not just their transactions,” and 61% say they trust fintechs more than banks because they feel “more aligned” with their values and communication style. This is what happens when money stops being private and becomes cultural currency. Money is emotional, social, and aesthetic. Fintech is finally adapting.

From product → ecosystem

Traditional banks sell a single-service relationship.

Modern fintech sells a multi-touch ecosystem:

early pay access

savings automation

credit building

cash-flow insights

rewards and perks

financial wellness tools

community events, educational content, or creator-driven experiences

In other words, fintech is becoming a lifestyle membership disguised as a financial app.

This change didn’t happen accidentally. It happened because the economic model demanded it. CAC has risen by 60% in five years. Consumers churn quickly if they perceive no long-term value. Membership models solve this by stacking benefits in a way that creates stickiness, not through contracts, but through psychology.

Why membership works: the emotional layer

The truth is simple: people don’t stay loyal to utilities.

They stay loyal to identities.

A debit card will never feel like a tribe.

A financial membership can.

Membership reframes money from anxiety → empowerment. It signals:

“You’re part of something, and we’re here to support your entire financial life, not just process your payments.”

Just like beauty communities gather around routines, finishes, and aesthetics, fintech communities gather around stability, aspiration, and upward mobility.

This is why fintech brands lean into:

warm, conversational tone

minimal branding and aesthetic clarity

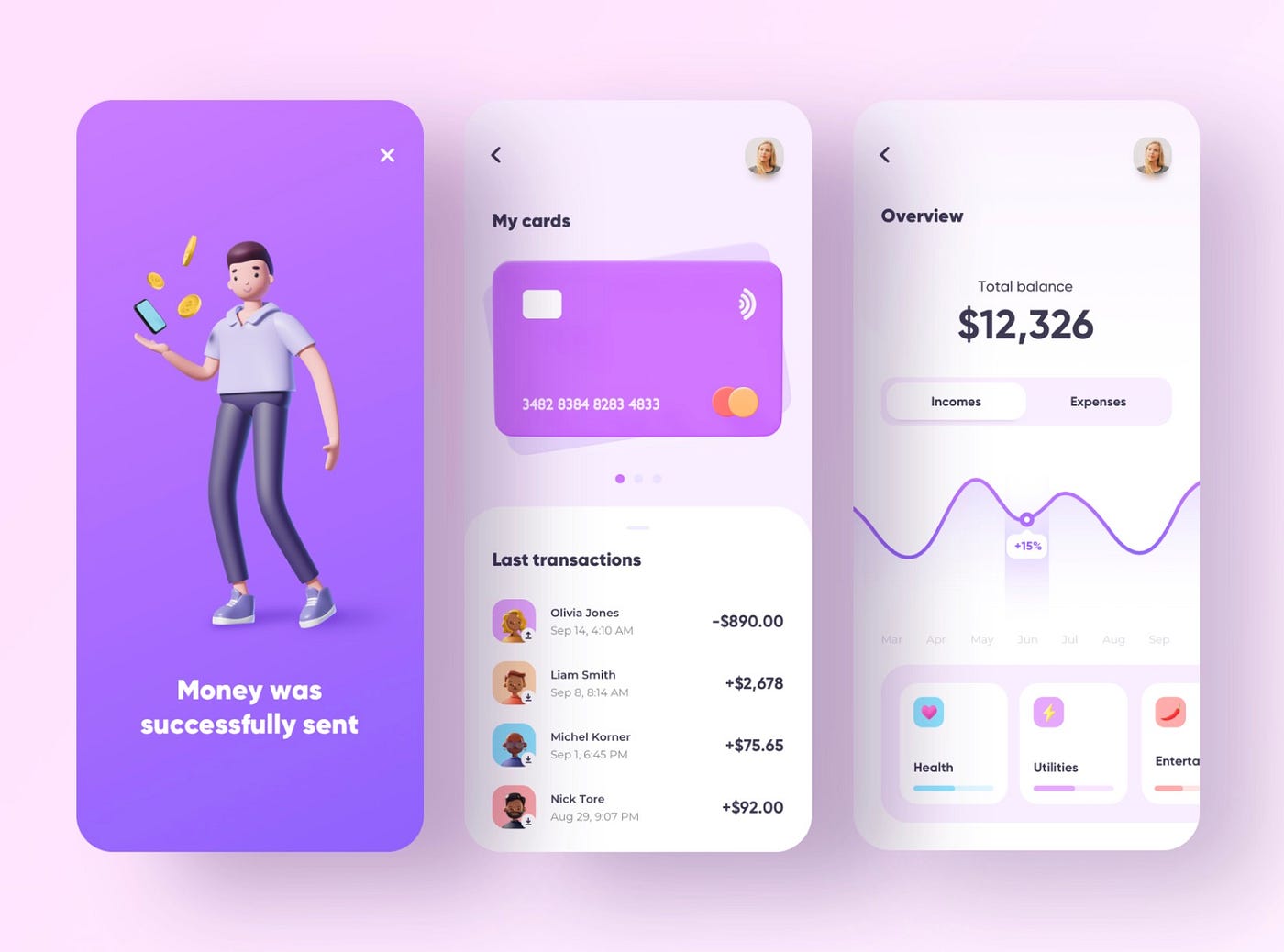

dashboards that feel calming, not overwhelming

affirmational nudges rather than warnings

content that looks more wellness than banking

Finance adopted the language of lifestyle because consumers needed emotional safety before they could make better decisions.

The rise of “financial wellness” as brand religion

A decade ago, financial wellness was a boring HR benefit.

Today, it’s the closest thing fintech has to a belief system.

Search volume for “financial wellness tools” is up more than 140% since 2020.

Apps that integrate:

spending awareness

micro-education

savings behavior modeling

debt stress reduction

cash-flow visibility

have 2–3x higher monthly retention compared to single-feature apps.

Consumers don’t just want access. They want guidance.

That is the key distinction:

Fintech no longer sells utility. It sells a path.

This is the same psychological lever that turned fitness into lifestyle, beauty into identity, and food into community. When an industry becomes emotional, it becomes cultural. And when it becomes cultural, membership is the natural evolution.

Why cash-access perks are the new “glazed skin effect”

Rhode used one promise, glazed skin, to anchor the brand.

Fintech is using a different promise: access when you need it.

Early pay, cash boosts, flexible access, fee-free structures. none of these are new, but when packaged inside a membership narrative, they stop feeling like “utilities” and start feeling like lifestyle benefits.

Consumers think in outcomes, not features:

“I don’t want overdraft panic.”

“I want breathing room.”

“I want to feel in control.”

Fintech brands that position access as part of a membership identity (rather than a standalone product) build trust faster and retain users longer. It’s Rhode’s playbook translated into the money world: simple promise, cohesive execution, strong identity.

Fintech’s next decade: less banking, more belonging

Membership is not a trend, it’s the structural answer to what modern consumers want from their financial life:

personalization

education

aesthetic confidence

emotional alignment

access without shame

a community that “gets” them

This is the new moat.

Not APR. Not features.

Belonging.

Fintech is becoming a lifestyle because money has always been emotional, the industry simply wasn’t honest about it until now.

For years, fintech sold products: cards, loans, budgeting tools, APRs, overdraft avoidance. It was transactional, functional, and aggressively rational. But the industry has quietly hit a ceiling. Consumers no longer want “a financial tool.” They want a financial identity, something that feels like them, supports their lifestyle, and softens the psychological friction around money.

That shift is why fintech’s next era isn’t defined by lending innovations or new rails. It’s defined by membership.

In 2025, over 72% of Gen Z consumers say they want financial products that “fit their life, not just their transactions,” and 61% say they trust fintechs more than banks because they feel “more aligned” with their values and communication style. This is what happens when money stops being private and becomes cultural currency. Money is emotional, social, and aesthetic. Fintech is finally adapting.

From product → ecosystem

Traditional banks sell a single-service relationship.

Modern fintech sells a multi-touch ecosystem:

early pay access

savings automation

credit building

cash-flow insights

rewards and perks

financial wellness tools

community events, educational content, or creator-driven experiences

In other words, fintech is becoming a lifestyle membership disguised as a financial app.

This change didn’t happen accidentally. It happened because the economic model demanded it. CAC has risen by 60% in five years. Consumers churn quickly if they perceive no long-term value. Membership models solve this by stacking benefits in a way that creates stickiness, not through contracts, but through psychology.

Why membership works: the emotional layer

The truth is simple: people don’t stay loyal to utilities.

They stay loyal to identities.

A debit card will never feel like a tribe.

A financial membership can.

Membership reframes money from anxiety → empowerment. It signals:

“You’re part of something, and we’re here to support your entire financial life — not just process your payments.”

Just like beauty communities gather around routines, finishes, and aesthetics, fintech communities gather around stability, aspiration, and upward mobility.

This is why fintech brands lean into:

warm, conversational tone

minimal branding and aesthetic clarity

dashboards that feel calming, not overwhelming

affirmational nudges rather than warnings

content that looks more wellness than banking

Finance adopted the language of lifestyle because consumers needed emotional safety before they could make better decisions.

The rise of “financial wellness” as brand religion

A decade ago, financial wellness was a boring HR benefit. Today, it’s the closest thing fintech has to a belief system. Search volume for “financial wellness tools” is up more than 140% since 2020.

Apps that integrate:

spending awareness

micro-education

savings behavior modeling

debt stress reduction

cash-flow visibility

have 2–3x higher monthly retention compared to single-feature apps.

Consumers don’t just want access.

They want guidance.

That is the key distinction:

Fintech no longer sells utility. It sells a path.

This is the same psychological lever that turned fitness into lifestyle, beauty into identity, and food into community. When an industry becomes emotional, it becomes cultural. And when it becomes cultural, membership is the natural evolution.

Why cash-access perks are the new “glazed skin effect”

Rhode used one promise, glazed skin, to anchor the brand. Fintech is using a different promise: access when you need it.

Early pay, cash boosts, flexible access, fee-free structures, none of these are new, but when packaged inside a membership narrative, they stop feeling like “utilities” and start feeling like lifestyle benefits.

Consumers think in outcomes, not features:

“I don’t want overdraft panic.”

“I want breathing room.”

“I want to feel in control.”

Fintech brands that position access as part of a membership identity (rather than a standalone product) build trust faster and retain users longer. It’s Rhode’s playbook translated into the money world: simple promise, cohesive execution, strong identity.

Fintech’s next decade: less banking, more belonging

Membership is not a trend — it’s the structural answer to what modern consumers want from their financial life:

personalization

education

aesthetic confidence

emotional alignment

access without shame

a community that “gets” them

This is the new moat.

Not APR. Not features.

Belonging.

Fintech is becoming a lifestyle because money has always been emotional, the industry simply wasn’t honest about it until now.

For years, fintech sold products: cards, loans, budgeting tools, APRs, overdraft avoidance. It was transactional, functional, and aggressively rational. But the industry has quietly hit a ceiling. Consumers no longer want “a financial tool.” They want a financial identity, something that feels like them, supports their lifestyle, and softens the psychological friction around money.

That shift is why fintech’s next era isn’t defined by lending innovations or new rails. It’s defined by membership.

In 2025, over 72% of Gen Z consumers say they want financial products that “fit their life, not just their transactions,” and 61% say they trust fintechs more than banks because they feel “more aligned” with their values and communication style. This is what happens when money stops being private and becomes cultural currency. Money is emotional, social, and aesthetic. Fintech is finally adapting.

From product → ecosystem

Traditional banks sell a single-service relationship.

Modern fintech sells a multi-touch ecosystem:

early pay access

savings automation

credit building

cash-flow insights

rewards and perks

financial wellness tools

community events, educational content, or creator-driven experiences

In other words, fintech is becoming a lifestyle membership disguised as a financial app.

This change didn’t happen accidentally. It happened because the economic model demanded it. CAC has risen by 60% in five years. Consumers churn quickly if they perceive no long-term value. Membership models solve this by stacking benefits in a way that creates stickiness, not through contracts, but through psychology.

Why membership works: the emotional layer

The truth is simple: people don’t stay loyal to utilities.

They stay loyal to identities.

A debit card will never feel like a tribe.

A financial membership can.

Membership reframes money from anxiety → empowerment.

It signals: “You’re part of something, and we’re here to support your entire financial life. not just process your payments.”

Just like beauty communities gather around routines, finishes, and aesthetics, fintech communities gather around stability, aspiration, and upward mobility.

This is why fintech brands lean into:

warm, conversational tone

minimal branding and aesthetic clarity

dashboards that feel calming, not overwhelming

affirmational nudges rather than warnings

content that looks more wellness than banking

Finance adopted the language of lifestyle because consumers needed emotional safety before they could make better decisions.

The rise of “financial wellness” as brand religion

A decade ago, financial wellness was a boring HR benefit.

Today, it’s the closest thing fintech has to a belief system.

Search volume for “financial wellness tools” is up more than 140% since 2020.

Apps that integrate:

spending awareness

micro-education

savings behavior modeling

debt stress reduction

cash-flow visibility

have 2–3x higher monthly retention compared to single-feature apps.

Consumers don’t just want access. They want guidance.

That is the key distinction:

Fintech no longer sells utility. It sells a path.

This is the same psychological lever that turned fitness into lifestyle, beauty into identity, and food into community. When an industry becomes emotional, it becomes cultural. And when it becomes cultural, membership is the natural evolution.

Why cash-access perks are the new “glazed skin effect”

Rhode used one promise, glazed skin, to anchor the brand.

Fintech is using a different promise: access when you need it.

Early pay, cash boosts, flexible access, fee-free structures; none of these are new, but when packaged inside a membership narrative, they stop feeling like “utilities” and start feeling like lifestyle benefits.

Consumers think in outcomes, not features:

“I don’t want overdraft panic.”

“I want breathing room.”

“I want to feel in control.”

Fintech brands that position access as part of a membership identity (rather than a standalone product) build trust faster and retain users longer.

Fintech’s next decade: less banking, more belonging

Membership is not a trend, it’s the structural answer to what modern consumers want from their financial life:

personalization

education

aesthetic confidence

emotional alignment

access without shame

a community that “gets” them

This is the new moat.

Not APR. Not features.

Belonging.

Fintech is becoming a lifestyle because money has always been emotional, the industry simply wasn’t honest about it until now.